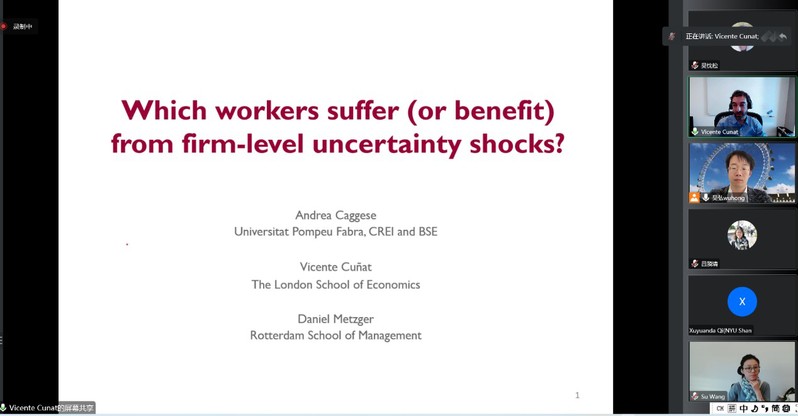

On October 18th,2022, the 36th Fudan-LSE Lecture Series was held online. Vicente Cuñat, professor of finance at the London School of Economics, delivered a lecture entitled ‘Which workers suffer (or benefit) from firm-level uncertainty shocks?’. More than 70 teachers and students from Fudan and other universities at home and abroad attended the lecture which was chaired by Mr. Wu Hong from the School of Economics of Fudan University.

At the very beginning, Mr. Wu Hong introduced the resume and career background of Professor Vicente Cuñat. Professor Cuñat is currently an internationally renowned scholar in the field of corporate finance and corporate governance with a wide range of research interests. He has also made great achievements in banking, applied theory and applied econometrics. Professor Cuñat has published papers in many top international academic journals, which have exerted considerable influence in the field of corporate finance.

In this lecture,Professor Vicente Cuñat shared his latest working paper revolving around uncertainty. The first part is the brief introduction of uncertainty shocks and corporate decisions. He pointed out that scholars have already done rich research on uncertainty and fixed investment from the perspective of macroeconomics, real options and industrial economics. By contrast, research on the relationship between uncertainty and employment decisions is lackluster. It is with the “workforce” at its core that this paper explores a heterogeneity analysis on how firm-level uncertainty affects firing and hiring decisions of different employees.

Next, Professor Cuñat described a stylized model to figure out the heterogeneous effects of different employees in terms of hiring and firing decisions. Meanwhile, he developed a new method for estimating the firm-level uncertainty index. On this basis, Professor Vicente Cuñat used series of quite novel empirical data, including the population and employer-employee matched social security data (1990-2014) in LISA data from Statistics Sweden (SCB), firm data such as balance sheets and income statements of all LLCs, and daily spot or future commodity price for 20 commodities for 1997-2017, and thus estimated the effect of uncertainty shocks on firing and hiring decisions of heterogeneous workers categorized by age, skill, Occupation, etc. Finally, according to the empirical results, on one hand, exogenous shocks to profit levels severely hit the aggregate employment levels, while the impact on different types of workers is homogeneous; on the other hand, however, an increase in profit uncertainty has no impact on aggregate employment levels, but exerts heterogeneous effects on different types of workers, such as older and longer-tenured workers and those in reallocation-prone occupations are more likely to be fired, and workers with previous experience in the sector are more likely to be hired, while skilled or educated workers are more likely to be hired and/or fired. Besides, uncertain periods have drived experimentation in corporate governance and creative disruption of conventional employment, namely altering the pecking order of firing, reallocation of workers within the firm as a substitute of firing, etc.

During the presentation, Professor Vicente Cuñat actively interacted with the teachers and students present. At the end of the lecture, he also answered questions patiently and meticulously, drawing a successful conclusion to the event.