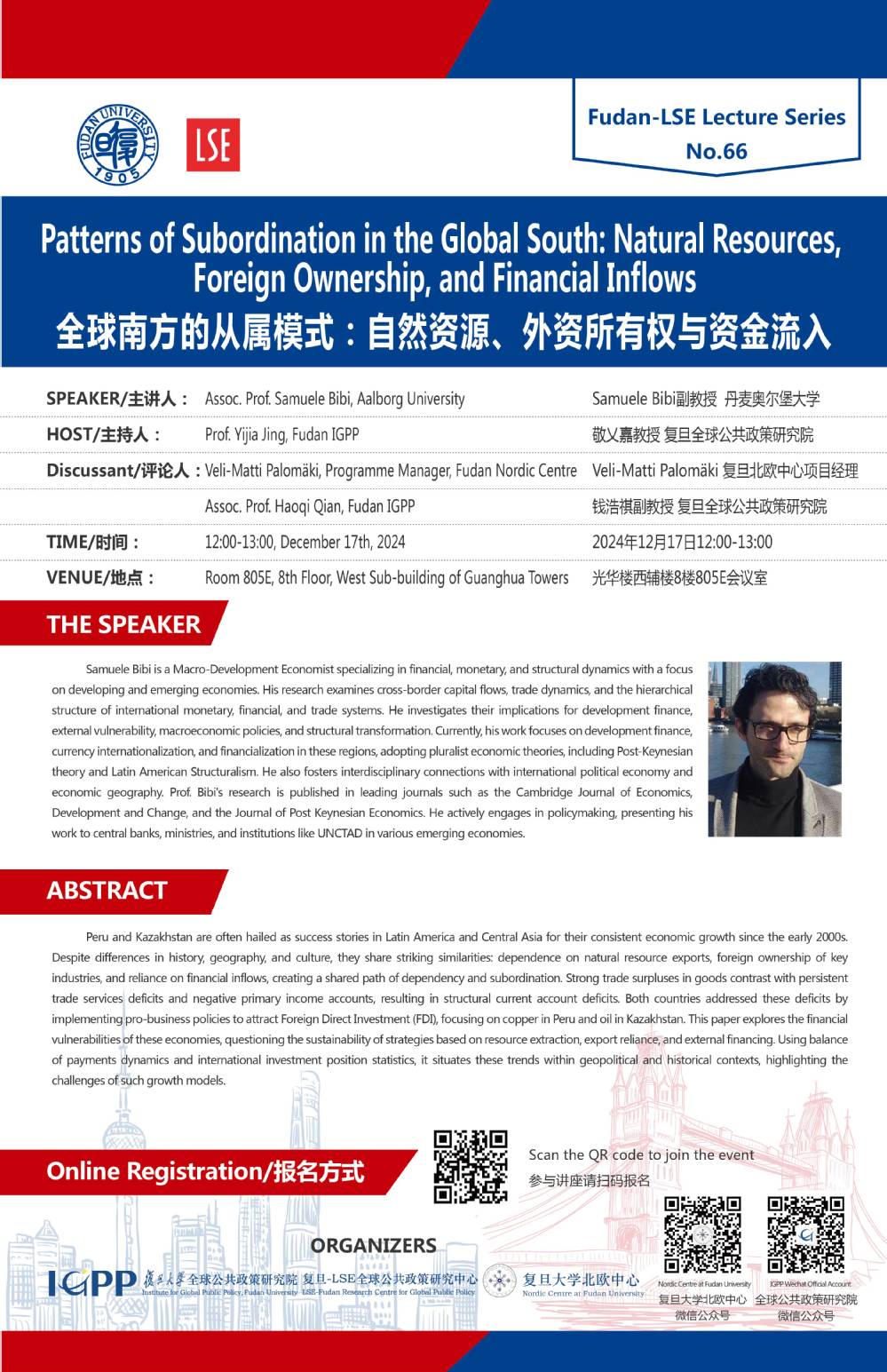

Fudan-LSE Lecture Series No.66

Title:

Patterns of Subordination in the Global South: Natural Resources, Foreign Ownership, and Financial Inflows

Speaker:

Assoc. Prof. Samuele Bibi, Aalborg University

Host:

Prof. Yijia Jing, Fudan IGPP

Discussant:

Veli-Matti Palomäki, Programme Manager, Fudan Nordic Centre

Assoc. Prof. Haoqi Qian, Fudan IGPP

Time:

12:00-13:00, December 17th, 2024

Venue:

Room 805E, 8th Floor, West Sub-building of Guanghua Towers

https://www.wjx.cn/vm/Ot6BwgF.aspx#

The Speaker:

Samuele Bibi is a Macro-Development Economist specializing in financial, monetary, and structural dynamics with a focus on developing and emerging economies. His research examines cross-border capital flows, trade dynamics, and the hierarchical structure of international monetary, financial, and trade systems. He investigates their implications for development finance, external vulnerability, macroeconomic policies, and structural transformation. Currently, his work focuses on development finance, currency internationalization, and financialization in these regions, adopting pluralist economic theories, including Post-Keynesian theory and Latin American Structuralism. He also fosters interdisciplinary connections with international political economy and economic geography. Prof. Bibi’s research is published in leading journals such as the Cambridge Journal of Economics, Development and Change, and the Journal of Post Keynesian Economics. He actively engages in policymaking, presenting his work to central banks, ministries, and institutions like UNCTAD in various emerging economies.

Peru and Kazakhstan are often hailed as success stories in Latin America and Central Asia for their consistent economic growth since the early 2000s. Despite differences in history, geography, and culture, they share striking similarities: dependence on natural resource exports, foreign ownership of key industries, and reliance on financial inflows, creating a shared path of dependency and subordination. Strong trade surpluses in goods contrast with persistent trade services deficits and negative primary income accounts, resulting in structural current account deficits. Both countries addressed these deficits by implementing pro-business policies to attract Foreign Direct Investment (FDI), focusing on copper in Peru and oil in Kazakhstan. This paper explores the financial vulnerabilities of these economies, questioning the sustainability of strategies based on resource extraction, export reliance, and external financing. Using balance of payments dynamics and international investment position statistics, it situates these trends within geopolitical and historical contexts, highlighting the challenges of such growth models.